Amid the complicated Covid-19 epidemic, e-commerce is thought to face a new opportunity to grow. However, after the first quarter, did Vietnamese e-commerce companies manage to take advantage of this opportunity?

E-commerce aggregator iPrice Group and analytics company SimilarWeb announced the latest Vietnamese Map ofE-Commerce for Quarter 1, 2020. The report analysing traffic statistics of the 50 leading e-commerce websites in Vietnam to answer this question.

Tiki is once again the 2nd most visited marketplace

The report reveals that local e-commerce marketplace Tiki has now returned to the top 2 of national marketplacesafter being behind Sendo for two quarters. After the first quarter, Tiki’s website received 23.99 million visits permonth, a slight decrease compared to Q4 / 2019.

The number of visits to the websites of Lazada Vietnam and Sendo in the first quarter respectively decreased by 7.3 million / month and 9.6 million / month compared to the previous quarter.

Number 1 nationwide is once again Shopee Vietnam with 43.16 million website visits / month. Shopee Vietnam also increased their web traffic by 5.2 million visits / month quarter-over-quarter. This marks the third consecutive quarter that Shopee Vietnam has experienced a growth in website traffic.

Thus, in this quarter, the major E-commerce marketplaces, except Shopee, saw their web traffic decreased by an average of 9% compared to the same period in 2019.

According to iPrice Group’s analysts, part of the reason is that during the Covid-19 epidemic, e-commerce marketplaces tend to restrict advertising and promotion activities, and instead start to promote livestreaming and games on their applications. The goal is to take advantage of the situation to increase customer engagement, and test new features.

Another major reason is that demands for online shopping during the epidemic keep changing quickly and unpredictably, causing problems for E-commerce businesses.

How E-commerce changes because of Covid-19

iPrice Group’s data shows that due to the impact of the Covid-19 epidemic, in this first quarter, there were some online product categories that suddenly became highly in-demand.

The most major one is the healthcare category. In February, online demands for facemasks and hand sanitizersincreased by 610% and 680% respectively compared to January, as recorded on iPrice.vn.

By March, when more consumers stay at home to avoid outbreaks, it was then the turn for online grocery to take the throne. Visits to online grocery retailer Bach Hoa Xanh’s website this quarter increased by 49% quarter-over-quarter.

Unfortunately, these categories were not previously the focus of Vietnam’s e-commerce market. Among the top 50 e-commerce websites in Vietnam, only two are specialized in online grocery, while 10 are mobile device retailers, 9 are electronics retailers, and 7 are fashion retailers.

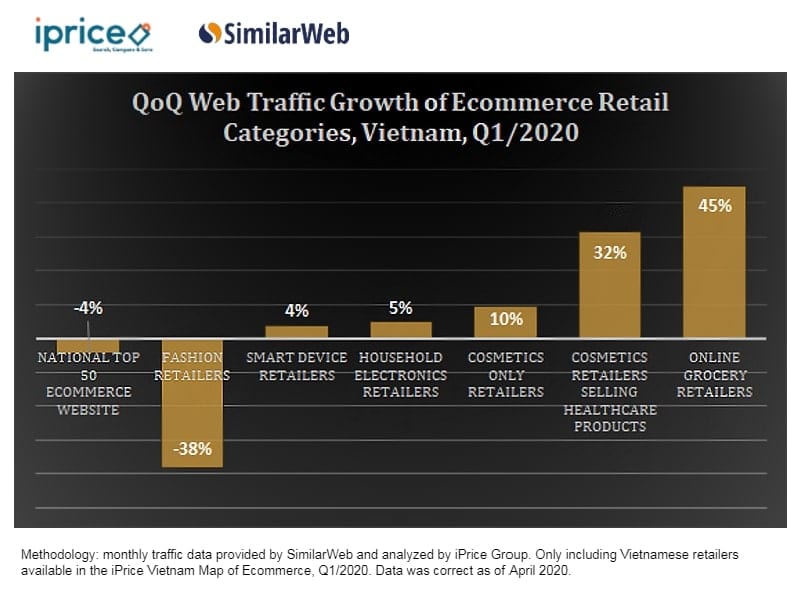

In contrast, the product categories that are traditionally the “golden eggs” of Vietnamese e-commerce such as fashion and electronics, were affected negatively during this epidemic.

In the first 3 months of the year, fashion retail websites experienced an average decrease of 38% in traffic compared to the previous quarter.

Similarly, traffic to household electronics retail websites in February decreased by 17% compared to January. Luckily, by March, when people start looking for laptops, webcams, microphones, and monitors, etc. to work from home, this category has recovered.

Thus, after only the first 3 months of the year, Vietnamese E-commerce has experienced a lot of sudden changes due to the influence of Covid-19. This brings about both new opportunities and challenges for e-commerce businesses, requiring them to be quick to react and ready to change.

For example, some cosmetics online businesses now start selling facemasks and hand sanitizers. Results showed that traffic to these websites in the first quarter grew by an average of 32% quarter-over-quarter. Comparatively, for websites that sell solely cosmetics, the average increase is only 10%.

Meanwhile, the four major e-commerce marketplaces began to focus on promoting grocery and healthcare products quite late, way into March. Before that, they were still seen pushing for fashion, electronics, and cosmetics on theirhomepage and in their promotional campaigns.

These slow responses somewhat prevented e-commerce from taking full advantage of the opportunities brought byCovid-19.

However, after these marketplaces started to change their focuses according to the new demands of the market, by the end of the first quarter, their website traffic also started to grow again, showing signs of hope for Vietnamese E-commerce in the months to come.

About iPrice Group

iPrice Group is a meta-search website operating in seven countries across Southeast Asia namely in; MalaysiaSingapore, Indonesia, Thailand, Philippines, Vietnam, and Hong Kong. Currently, iPrice compares and catalogues more than 500 million products and receives close to 20 million monthly visits across the region. iPrice currently operates three business lines: price comparison for electronics and health & beauty; product discovery for fashion and home & living; and coupons across all verticals.

Source: iPrice

The post Analysing Vietnamese e-commerce during the Covid-19 epidemic: missed opportunities appeared first on Advertising Vietnam.

Analysing Vietnamese e-commerce during the Covid-19 epidemic: missed opportunities posted first on https://advertisingvietnam.com

Không có nhận xét nào:

Đăng nhận xét